39+ mortgage interest deduction california

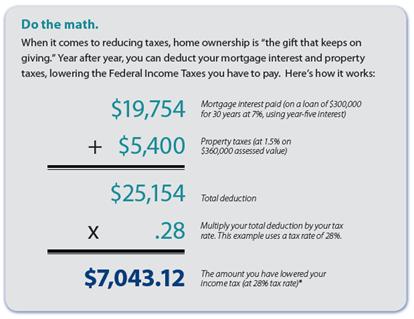

That means that the mortgage interest you. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan.

Mortgage Interest Deduction Changes In 2018

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

. The bill would have also. Web California does not permit a deduction for foreign income taxes. Web Deduction CA allowable amount Federal allowable amount.

Web Even the Trump administration thought that the MID cap was excessive and capped the federal deduction at 750000 per home. California has around 40 million. Discover Helpful Information And Resources On Taxes From AARP.

See what makes us different. Take Advantage And Lock In A Great Rate. Federal changes limited the mortgage interest deduction debt maximum from 1000000 500000 for.

We dont make judgments or prescribe specific policies. Expenses that exceed 75 of your federal AGI. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Medical and dental expenses. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Use NerdWallet Reviews To Research Lenders.

Web According to the Tax Cuts and Jobs Act of 2017 taxpayers may deduct up to 750000 in home loan interest for homes purchased as of December 16th 2017. Homeowners who bought houses before. Web California currently allows the deduction to apply to interest on debt of up to 1 million owed for a taxpayers first and second homes.

Web The federal tax law changes at the end of 2017 limited the amount of mortgage interest you could deduct on your federal return. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. While the full details are in.

On home purchases up to 1000000. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Expenses that exceed 75 of your federal AGI.

Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly.

Mortgage Interest Tax Deduction What You Need To Know

Coming Home To Tax Benefits Windermere Real Estate

Crc Def14a 20200506 Htm

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

Is Home Equity Loan Interest Tax Deductible In California

Mortgage Interest Tax Deduction Smartasset Com

Changes To California Mortgage Interest Deduction Limit In 2018

Rural Change And Royal Finances In Spain

California Risks Losing Two Of It S Most Significant Tax Deductions

The Mortgage Interest Deduction Tax Subsidy For The Rich Must Go The Sacramento Observer

Is My Mortgage Interest Still Tax Deductible The Henry Levy Group A Cpa Firm

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

California Bill Would Limit Mortgage Interest Deduction

Itemized Deductions For California Taxes What You Need To Know

Californians Home Mortgage Deduction Would Be Capped Under New Bill

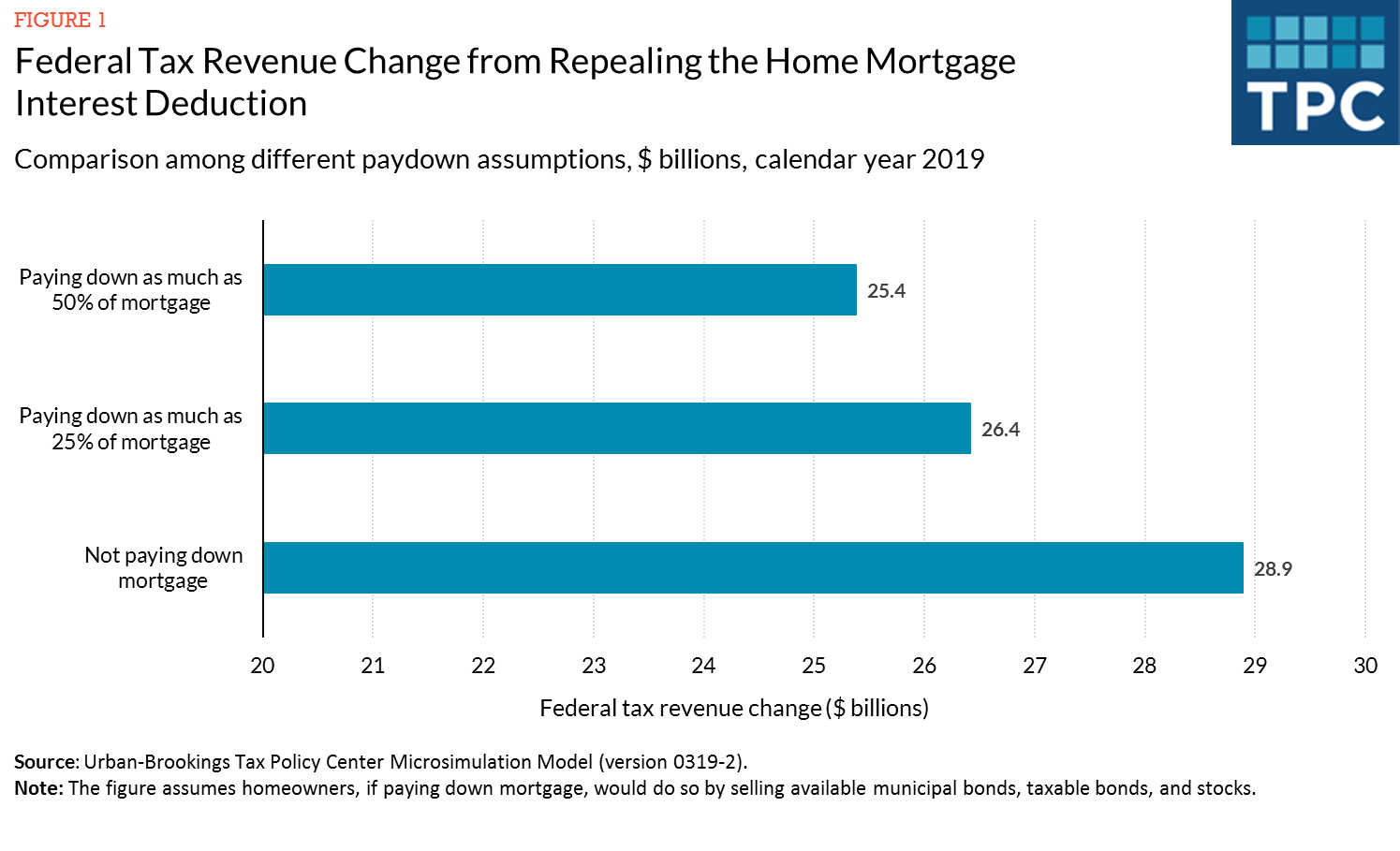

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Mortgage Tax Deductions What Is Tax Deductible San Diego Purchase Loans